Propaganda: The Rich aren’t paying their fair share. We have Income Inequality! Raise taxes on the 1% to make it fair for all Americans!

Propaganda: The Rich aren’t paying their fair share. We have Income Inequality! Raise taxes on the 1% to make it fair for all Americans!

FACTS:

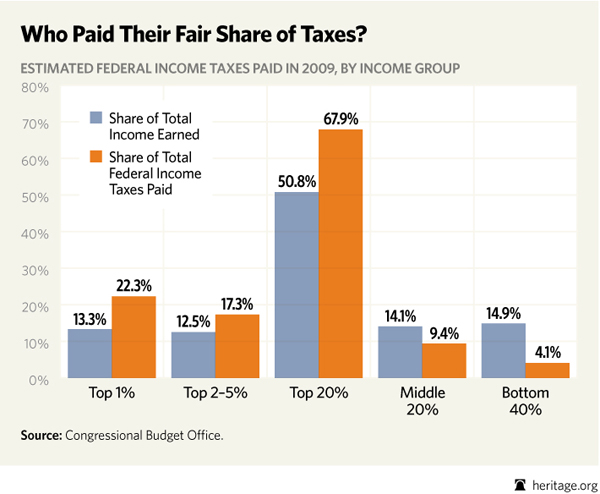

The CBO, in a report released on July 10, 2012, detailed the Distribution of Household Income and Federal Taxes for the years 2008 and 2009. Here are the findings:

- The top 1% earned 13.3% of all income and paid 22.3% of all taxes, or 67% more than their fair share of income.

- The top 20% earned 50.8% of all income and paid 67.9% of all taxes, or 33% more than their fair share of income.

- The middle 20% (middle class) earned 14.1% of all income and paid 9.4% of all taxes, or 33% less than their fair share of income.

- The bottom 40% earned 14.9% of all income and paid 4.1% of all taxes, or 73% less than their fair share of income.

Or if you prefer pictures, here’s a simple graph from The Heritage Foundation:

Here are some additional insights from the report:

- The top 1% have an effective tax rate (the amount you actually pay as a percent of income after all deductions) of 29%.

- Under Obama, the top 20% have seen their share of income fall, while lower percentile groups have seen it rise (income redistribution, well on its way).

So, what have we learned?

- The wealthy are paying far more federal income tax than their share of income

- The middle class is paying far less in federal taxes than its share of income

- And “the poor” are paying almost no federal income tax at all.

The wealthy, the successful, are not only paying their fair share they’re providing federal services for more than 60% of Americans who are not paying their fair share.

Just say thank you, Class Warriors. And be on your way.

Update: In December, 2013, CBO released the same report for 2010. To see those results, read my post: No, The Rich Aren’t Getting Tax Breaks.

[…] my post Yes, The Rich Are Paying More Than Their Fare Share we looked into the disparity of federal income tax paid by the wealthy, relative to their share of […]

LikeLike

[…] my post The Rich Aren’t Paying Their Fair Share? we looked into the disparity of federal income tax paid by the wealthy, relative to their share of […]

LikeLike

Per the link provided and the second chart on that page (by “Income Group”), looks like the Top 1% earned more like 30%+ of all income and not 13% as mentioned in your post (second bullet). Am I missing something? Am I interpreting something different? Thanks.

LikeLike

Since the Government take so much to run, how much is of course debatable, and the non rich have the ability to pay limited amounts, without going on entitlement programs, the higher income individuals have to pay a higher rate to keep the Government functioning. Now each of us has our opinion as to what the Government should provide. My opinion is that we provide for our own defense, not the worlds, and eliminate to massive wastage and payoffs, think Halliburton, and cut the defense budget by roughly 50%. And cut the Corporate entitlement programs 100%, along with the tax credits for those without the needs other than political favors. End Capital Gain lower rates while we’re at it, and the “Special Tax Rate” for Hedge Fund managers. And enforce “Criminal Laws” against ALL law breakers, including “Hard Time” against the responsible Corporate Executives along with the called for triple damages as fines, and not keeping of ill gotten gains.

Not a problem!,

A Damned Liberal

LikeLike

When you are counting income does that include capital gains? A large portion of the 1% take their income through strategies that linked to capital gains.

LikeLike

Oh, please

LikeLike

As always, it depends on your definition of “fair.” Having higher income individuals pay at a higher rate is fair only if you think taxes are there to redistribute wealth — or at least that this is one reason (this argument always reminds me of “from each according to his abilities, to each according to his needs). If you believe that the purpose of taxes is to pay for government services and nothing more, then the only fair way to do it is to tax everyone at the same rate.

LikeLike

Bingo. A flat tax is the answer. Of course, the author of your quote, Karl Marx, would not approve.

LikeLike

Love it, but how usable is it in a debate? Usability for me is defined by source material. Your sources are lacking on this. You’ve got sourcing for the first two points, but the others? Is the CBO the source for all of them or are there other sources? I’m very curious, I would love to look into them.

LikeLike

CBO is the source – link is in the body above

LikeLike

All about other people’s money with liberals.

LikeLike